Send Aid

Track Aid

Receive a Video

- Home

-

Women

-

Men

-

Jewelry

-

Wooden Product

-

Bags & Accessories

-

Ceramics

-

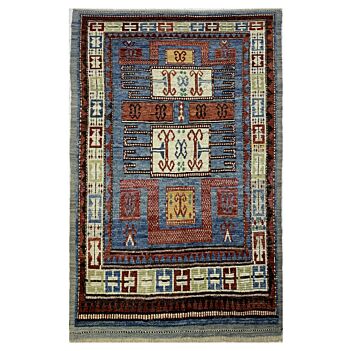

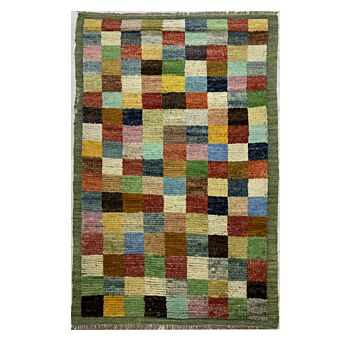

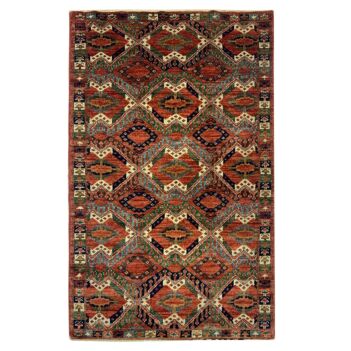

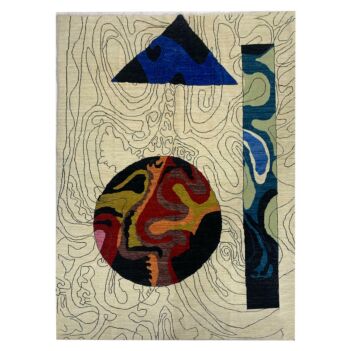

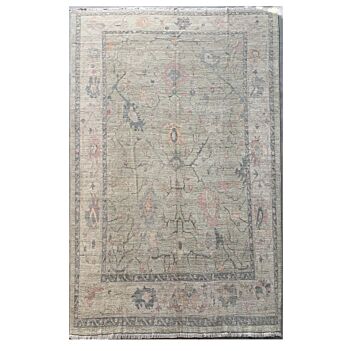

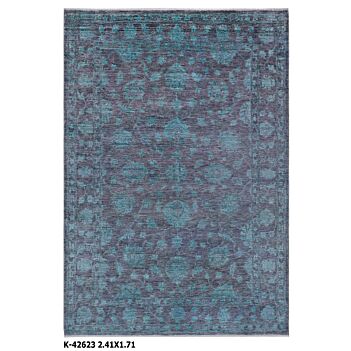

Carpets

-

Rugs

- Leather

Rugs

Area Rugs Runner Rugs Afghan Rugs Turkish Rugs Vintage Rugs Chobi Rugs Rug Wall Hanging Round Rugs Prayer Rugs Kilim Rugs 3 x 5 Area Rugs 4 x 5 Area Rugs 4 x 6 Area Rugs 5 x 7 Area Rugs 7 x 10 Area Rugs Small Area Rugs Medium Area Rugs Large Area Rugs Patterned Area Rugs Red Area Rugs Neutral Area Rugs Vintage Runner Rugs Geometric Runner Rugs 3 x 10 Runner Rugs

-

Rugs

Ceramics

HandmadeSHOP HANDMADE PRODUCTS DIRECTLY FROM ARTISANS

Lapis Lazuli Necklace

Lapis Lazuli Rough Cut Pe...

$52.00Lapis Lazuli Sautoir Pend...

$71.00Lapis Lazuli Diamond Cut ...

$40.00Lapis Lazuli Round Locket...

$28.00Lapis Lazuli Silver Neckl...

$65.00Lapis Lazuli Marquise Jew...

$109.00Matching Lapis Necklace a...

$98.00Leaf Lapis Lazuli Locket ...

$34.00Handmade Art

Tree Branches Artwork| Be...

$52.00Realism Style Painting on...

$213.00Oil Color Forest Painting...

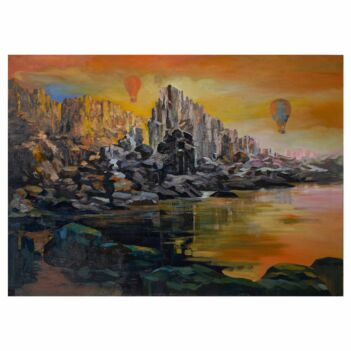

$31.00Sunrise Oil Painting | La...

$87.00Simple Flower Artwork | R...

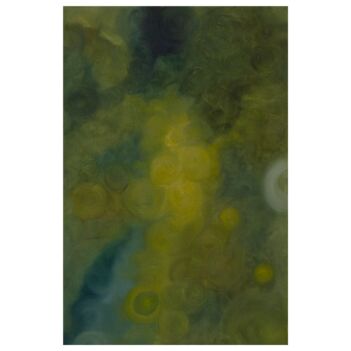

$45.00Modern Abstract Painting ...

$45.00Winter Landscape Painting...

$94.00Seascape Oil Painting | M...

$108.00Handmade Glassware Herati

Brownish Yellow Glass Set...

$26.00Sky Blue Handmade Glass S...

$26.00Handmade Dark Blue Glass ...

$26.00Handmade Dark Blue Glass ...

$26.00Green Poco Grande Handmad...

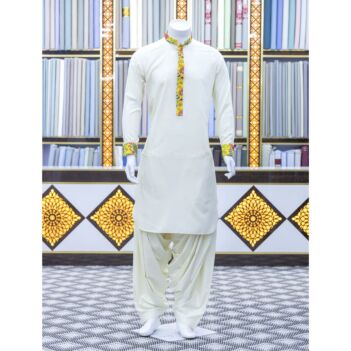

$11.00Afghan clothes for men

Lemonade Arabic Embroider...

$40.00Yellow Banarasi Full Flor...

$68.00Rose Quartz Indian Embroi...

$42.00Black Afghani Embroidered...

$42.00Blue Arabic Design Men�...

$41.00Black Afghani Embroidered...

$48.00White Cotton Men's O...

$41.00Peran o Tunban | Afghan T...

$69.00Lapis Lazuli Bracelet

Blue Lapis Lazuli Chain B...

$52.00Gold-Plated Lapis Bracele...

$53.00Matching Lapis Necklace a...

$98.00Square Lapis Lazuli Brace...

$52.00Lapis Pendant Set | Sauto...

$72.00Lapis Lazuli Jewelry Set ...

$86.00Lapis Beaded Bracelet | G...

$24.00Lapis Beaded Bracelet | B...

$38.00Gifts For Her

Green Short Jali Vintage ...

$199.00Aquamarine Tube-light Pen...

$58.00Green Emerald Stone Ring ...

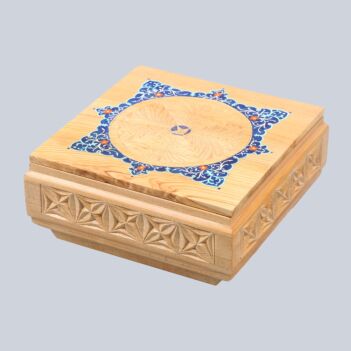

$77.00Jewelry Box

Watch box

$69.00Jewelry box

$58.00Cedar Wooden Jewelry Box ...

$44.00Jewelry or chocolates box

$44.00Jewelry or chocolates box

$44.00Jewelry or chocolates box

$51.00Jewelry box

$51.00Jewelry box

$211.00Necklaces

Green Emerald Gold Plated...

$534.00Green Emerald Silver Stat...

$582.00Green Emerald Silver Chok...

$600.00Spinel Stone Bib Necklace...

$260.00Three Stone Station Neckl...

$70.00Lapis Lazuli Stone Solita...

$38.00Agate Stone Negligee Jewe...

$395.00Multi Stone Station Neckl...

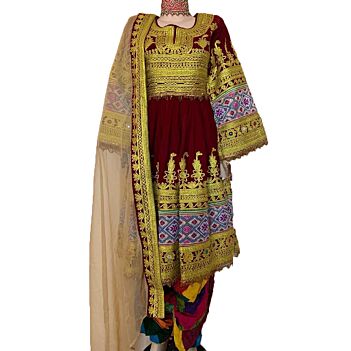

$115.00Gandi Afghani Dress

Green Graph Dozi Short Af...

Out of StockVelvet Full Embroidered G...

$265.00Velvet Bridal Gande Afgha...

$250.00Colorful Velvet Pleated S...

$82.00Red Silk Chemra Embroider...

$235.00Green Pleated 3-Piece Kuc...

$340.00Floral Cross-Stitch Pleat...

$129.00Earrings

Lapis Lazuli Round Dangle...

$19.00Amethyst & kunzite St...

$41.00Agate Stone Negligee Jewe...

$395.00Lapis Lazuli Dangle Earri...

$133.00Lapis Lazuli Silver Studs...

$41.00Lapis Lazuli Oval Jewelry...

$82.00Lapis Lazuli Round Jewelr...

$80.00Lapis Lazuli Drop Jewelry...

$133.00Patoo

Brown Nuristani Woolen Pa...

$69.00Yellowish Cream Nuristani...

$32.00Gray Nuristani Wool Patu ...

$96.00Off-White Nuristani Woole...

$96.00Light Gray Nuristani Patu...

$122.00Dark Gray Nuristani Woole...

$122.00Nuristani Patu

$122.00Nuristani Wool Patu

$108.00Ceremic Mug

Narin

$59.00Bold Ceramic Cup - Large ...

$49.00Look Ceramic Coffee Cup

$49.00alice handmade cup

$45.00Coffee cup Handmade moss ...

$49.00Handmade mug

$39.00Alice No .7 Handmade cup

$45.00Handmade Jewelry

Green Emerald Gold Plated...

$534.00Green Emerald Silver Stat...

$582.00Green Emerald Silver Chok...

$600.00Spinel Stone Bib Necklace...

$260.00Three Stone Station Neckl...

$70.00Lapis Lazuli Stone Solita...

$38.00Tourmaline Stone Solitair...

$110.00Lapis Lazuli Round Dangle...

$19.00Pakol

Dark Gray Nuristani Pakol...

$11.23Dark Brown Nuristani Pako...

$11.00Brown Nuristani Pakol | W...

$11.00Gifts For Him

Lilac Nuristani Tribal Pa...

$32.00White Hand Embroidered Af...

$99.00Brown Nuristani Woolen Pa...

$69.00Yellowish Cream Nuristani...

$32.00Gray Nuristani Wool Patu ...

$96.00Brownish Gray Classic Nur...

$32.00Black Classic Nuristani T...

$32.00Gray Nuristani Karaku Pak...

$32.00Bags & Accessories

Blue Beaded Mini Shoulder...

$22.00Gray and White Bead Embro...

$22.00Black Bead Embroidered Ha...

$22.00Dark blue Bead Embroidere...

$22.00White Beaded Handheld Bag...

$22.00Red Beaded Baguette Shoul...

$22.00Brown Handmade Embroidere...

$69.00Brown Handmade Cross-Body...

$69.00Bahar Season Sale

Gray Gabba Vintage Patter...

$522.00Green Gabba Square Patter...

$154.00Red Hand-woven Brick Desi...

$212.00White Geometric Shape Cla...

$619.00Reddish Green Hand-woven ...

$475.00Light Orange Qalamdani Ha...

$903.00Gray Ziglar Afghan Handma...

$363.00On Sale

Wedding Gifts

Matching Thread Embroider...

$68.00Green Beroj Stone Jewelry...

$132.00Black Sequin Maxi | Front...

$255.00Bright Marron color | Han...

$110.00Yellow Hazaragi Embroider...

$229.00Black Sleeveless Cherma E...

$99.00Afghan Traditional Dress ...

$61.00Emerald Gold-Plated Jewel...

$140.00Carpets

Tea Rose Qabqazistan Afgh...

$291.00Grayish Cream Turkish Ush...

$395.00Gray Gabba Vintage Patter...

$522.00Greenish Cream Gabba Afgh...

$400.00Blue Gabba Droplet Patter...

$514.00Moss Green Gabba Diamond ...

$216.00Black Kazak Triplet Desig...

$590.00Cream Gabba Diamond Patte...

$261.00Ceramics

Aristo - Coffee set

$229.00Narin

$59.00Gleam

$125.0012 Wells Ceramic Mixing P...

$59.00Ceramic Palette With Larg...

$59.00Christmas Color Ceramic C...

$99.00Handmade Plate

White Ceramic Flat Plate ...

$38.00Off-White Ceramic Small F...

$12.00White Flat Fresh Fruit Ce...

$15.00White Ceramic Fresh Fruit...

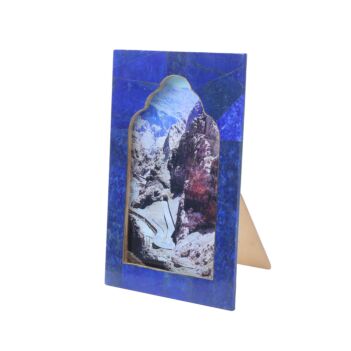

$15.00Lapis products

Lapis Lazuli & Garnet...

$177.00Lapis Lazuli Napkin Box |...

$87.00Lapis Lazuli Footed Bowl ...

$80.00Lapis Lazuli Floral Engra...

$66.00Lapis Lazuli Footed Plate...

$45.00Lapis Lazuli Stone Pen | ...

$19.00Lapis Lazuli Photo Frame ...

$45.00Lapis Lazuli Landscape Pi...

$66.00Istalif Pottery

Black & Brown Ceramic...

$9.00Genre Paintings

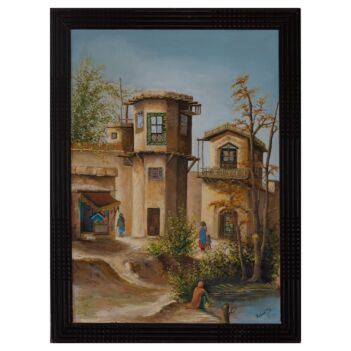

Spring Village View Paint...

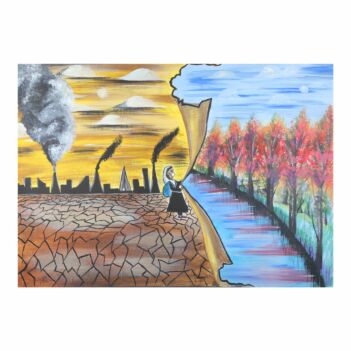

$83.48Global Warming Theme Artw...

$83.48Afghan Herbalist Portrait...

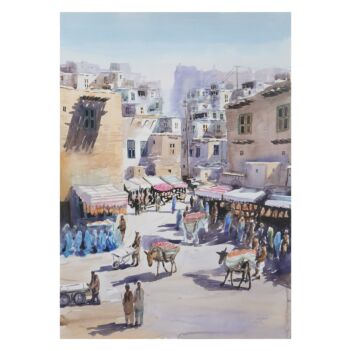

$101.00Old Kabul City Painting| ...

$150.00Afghan Village Life Artwo...

$150.00Art

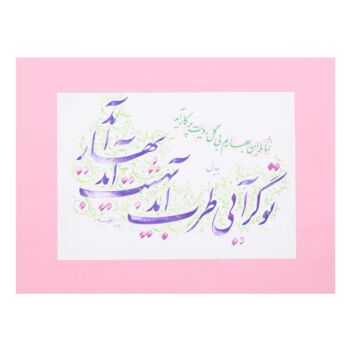

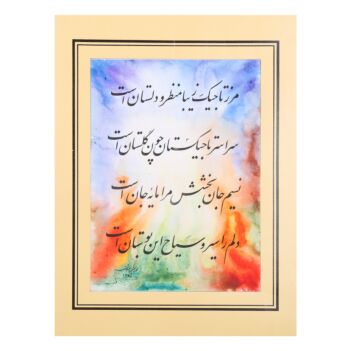

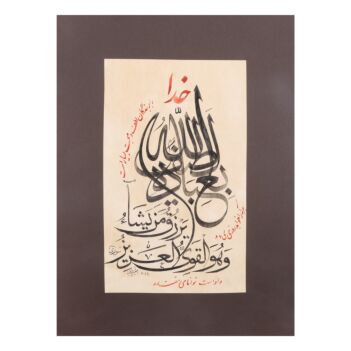

Farzand Hunar Poem| Persi...

$78.00Mohabbat Callgraphy| Nast...

$78.00Be Del Poem Nishat En Bah...

$103.00Marz Tajik Zeba Poem| Per...

$103.00Surattul Shura Calligraph...

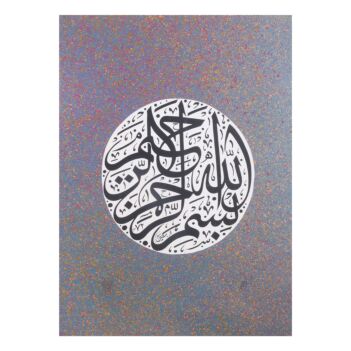

$103.00Bismillah Rahman Rahim Ca...

$78.00Hafiz Poem Man bi Tu| Per...

$78.00Hafiz Poem Baharo Gul| Pe...

$103.00Handmade Towels

Peshtemal, Bath Towel, Be...

$35.00Green 4 Layer Kimono, Sof...

$71.00Lima Blue Striped Cream P...

$37.00Lima Brown Striped Cream ...

$37.00Free Shipping

Pearl Pink Croc handmade ...

$164.00Ashley Crinkle Blue Gloss...

$178.00Large Ceramic Palette, Wa...

$59.0012 Wells Ceramic Mixing P...

$59.00Ceramic Palette With Larg...

$59.00Green Ceramic Candlestick...

$42.00Christmas Color Ceramic C...

$99.00Aseel Picks

Mustard Shah Maqsood Ston...

$75.60 Regular Price $84.00Green Agate Stone Ring| S...

$46.00Yellow Agate Men's R...

$25.00Turquoise Silver Men'...

$128.00Dark Brown Nuristani Pako...

$11.00Rough Aquamarine Studs | ...

$26.00Minimal Byzantine Earring...

$38.00Rugs

Dotun Handwoven Carpet | ...

$618.00Beautiful Ziglar Design C...

$168.00Gray Ziglar Afghan Handma...

$363.00Ziglar Design Handmade Ca...

$318.00beautiful Ziglar Afghan ...

$363.00New Ziglar Carpet | Afgha...

$378.00Ziglar Handwoven Carpet |...

$363.00Ziglar Design Beautiful C...

$153.00Wooden Products

Table clock

$40.00Table clock

$40.00Cedar Wood Dry Fruit Dish...

$30.00spoon box set wooden set ...

$86.00Watch box

$62.00Watch box

$69.00Jewelry box

$58.00Cedar Wooden Jewelry Box ...

$44.00New On Aseel

Green Emerald Silver Chok...

$600.00LAWANG | Dress for women ...

$199.00Brown Handmade Embroidere...

$69.00Brown Floral Embroidered ...

$69.00Red with White Freckle Ce...

$42.00Black Cherma Dozi Cocktai...

$137.00Lapis Lazuli Marquise Ear...

$18.00Leather

Barrel Zipped Bag | Embro...

$33.00Barrel Zipped Bag | Leath...

$33.00Flat Belt Bag | Leather W...

$24.00Leather Flip Wallet | Tri...

$17.00Shoulder Embroidered Bag ...

$33.00Buckle Flip Handmade Bag ...

$33.00Cross-Body Leather Bag | ...

$33.00Zip-Top Leather Bag | Han...

$31.00Stories

Aug 21, 2023World Humanitarian Day 2023: Join Aseel's Campaign to Aid Afghan Victims

In a world of unexpected challenges, this year, together with Aseel, let’s observe World Humanitarian Day 2023 with the act of compassion and kindness as the need for it is even more evident than ever every other second. World Humanitarian Day, celeb

Aug 21, 2023Simplifying Impact: Introducing Buy Good and Do Good Separation

At Aseel, we value our users and their feedback. Your input is important in shaping our platform and improving the user experience.

Jul 05, 2023Sell with Aseel Guide: Things to Know to Begin Your Shop!

Are you an artisan or handmade entrepreneur interested in selling online? Look no further, as we have got your back.

Jun 16, 2023Aseel Recognized in UK Parliament: A Closer Look at the Discussion

Aseel, a technology start-up committed to empowering artisans from under-developed and developing countries and providing vital humanitarian

Jun 15, 2023From Tradition to Style: The Enduring Appeal of the Afghan Pakol

The Afghan Pakol is a mesmerizing traditional wearing found in the untamed highlands of Afghanistan that reflects Afghan culture and history.

Jun 13, 2023From playing with paints and brushes to the magical artistic touch: The Journey of Zohra Jalal

Dipping brushes into a vibrant palette of colors and capturing emotions on canvas, the artistic journey of Zohra Jalal, a renowned Afghan painter, is a testament to the talent of self-expression.

Jun 01, 2023Eid-al-Adha Delights: Enjoy the Sales and Contribute to Eid Campaigns for Memorable Eid Celebrations!

As the Islamic year draws to an end, the celebration of Eid-al-Adha, known as the Feast of Sacrifice, followed by Hajj, the annual pilgrimage to Mecca, takes center stage.

May 13, 2023Invest In Aseel!

Aseel has a new five-year strategy that will set it on the path to being one of the most impactful companies globally. Our mission is to onbo

May 09, 2023Aseel Do Good's Impactful Distribution to Aid Turkey's Earthquake Survivors

On February 6th, 2023, a devastating earthquake at the magnitudes of 7.8 and 7.6 struck southern and central Turkey and northern and western Syria, causing widespread

May 01, 2023Turkmen Ancient Jewelry Designs: A Cultural Treasure Trove of Central Asia

Turkmenistan is a country located in Central Asia, known for its ancient and rich cultural heritage.

Apr 24, 2023“Holy Book of Quran” by Ahmad Shah Hazeri: In Calligraphy - A time-honored technique

Is there anything more exquisite than honing the art of hand calligraphy to design and write the Holy Quran?

Apr 19, 2023Combating the Hunger Crisis and Bringing Hope to Afghan Families

As a leading organization providing emergency assistance to Afghans, Aseel Do Good has been actively delivering food and essential supplies to vulnerable communities nationwide.

Apr 11, 2023Meet Two Afghan Vendors Trying to Earn a Living by Selling Unique Handcrafted Jewelry

The path from the rural corners of Afghanistan to the global stage is an arduous yet enlightening journey for many Afghan artisans.

Mar 29, 2023Eid al Fitr Gift Ideas: Shop Till You Drop With Our Amazing Eid Deals

Eid al Fitr, one of the most precious Islamic festivals, commemorates the conclusion of the sacred month of Ramadan,

Mar 13, 2023Pamper the Mother in Your Life : Handmade Gift Ideas for Mother's Day

Mothers' Day, a celebration in honor of mothers and motherhood is celebrated in many countries, typically in the month of May or March.

Mar 08, 2023Women's Day- Yay or Nay

As of 2022, there were a little over 3.9 billion women in the world. This accounts for about 50% of the total world population and this figure is believed to be increasing steadily.

Feb 23, 2023Clay and Creation: A Perfect Choice for Your Tableware

For centuries, creating a chic and inviting ambiance on dining tables has been a trend. People around the world search for beautiful, safe, and manageable tableware sets that complement their home decor.

Feb 16, 2023Deck Out Your Space With Hand-Woven Afghan Oriental Rugs

Afghan carpets and rugs have always been well-renowned for their delicate vintage designs, impeccable craftsmanship, and vibrant color schemes.

Jan 31, 2023Knock Knock, VALENTINE is on the way!

As the clock ticks down, mark your calendars for Valentine's Day Celebration. A day filled with love and affection cherished by couples worldwide.

Dec 13, 2022Last-Minute Gift Guide for Christmas

December is all about celebration, with Christmas taking precedence for the majority. To get this festivity done

Nov 23, 2022Astounding Handmade Collection from 5 Turkish Artisans

With ever-changing fashion trends and tendencies, Aseel is back with its five most popular Turkish artists

Oct 24, 2022Distribution Report from Nuristan

Aseel Do Good Team distributed 120 Emergency Food Packages in the Wama District of Nuristan.

Oct 20, 20225 Must-Have Wooden Items by Afghan Artists for Your Office Space

Having a vintage and antique office interior is in demand for many new and forthcoming office owners. Regardless of

Sep 22, 2022A letter from Nasrat Khalid, the Founder and Chief Executive Officer

This is Nasrat Khalid, the founder of Aseel. If you are receiving this note, I am confident that you are an amazing person

Sep 21, 2022Afghan Women Artisans Enter the Digital Economy

Women's inclusion in the digital world is frequently seen as one of the core missions of initiatives or businesses in today’s era.

Aug 14, 2022Look at how your support has enabled Aseel to save lives in Afghanistan

This August marks the one-year anniversary since the launch of Aseel’s emergency response campaign

Jul 06, 2022Aseel Earthquake Relief Efforts in Paktika

As news spread about the earthquake in eastern Afghanistan, Aseel immediately prepared and delivered 80 packages to the Gayan district in Paktika.

Jul 06, 2022Aseel Among Finalists in SID-US Innovation Competition

It is an outstanding accomplishment for Aseel to secure the finalist title in the Society for International Development United States (SID-US)

Jun 30, 2022Aseel’s Invitation to DEMAC's International Conference on Diaspora Humanitarianism

Aseel was invited to participate in the International Conference on Diaspora Humanitarianism as organized by Diaspora Emergency Action and

Jun 01, 2022Aseel’s invitation to the “AFGHAN DIASPORA CALL TO ACTION”, Conference, Brussels, Belgium

The Aseel PR lead was invited to participate in ‘Diaspora Action for Afghanistan,’ a two-day conference held in Brussels from the 15 to 16th of May, 2022. This conference aimed to identify immediate challenges Afghans face in Afghanistan and form re

Feb 02, 2022What are Aseel Omid ID Cards ?

One of the lessons learned the ASEEL team has picked up throughout our 4 years of experience in Afghanistan working with artisans and the humanitarian sector is that Afghanistan has always had the resources to support its population but there has alw

Jan 06, 2022Afghan entrepreneur’s e-commerce app pivots to help during crisis

In 2018, he made that dream a reality using $175,000 in savings and loans from family and friends, to launch the internet platform Aseel. The Etsy-style e-commerce site enables rural artisans to set their own prices and directly sell their handmad

Jan 04, 2022How Afghan E-Commerce Startup Aseel Is Pivoting to Help Its Compatriots In Need

When Mohammad Nasir went to a camp for internally displaced refugees in Kabul for the first time, people swarmed around him, trying to get their hands on packages of food he was carrying. In the desperate scrummage, Nasir was dragged around and ma

Aug 22, 2020Aseel Provides First Round of COVID Relief to Artisans

The Covid-19 pandemic has had detrimental effects on the global economy. Afghanistan, with an already compromised social and economical infrastructure, has been hit hard. With the risk that as much as 97% of the population is at risk of plunging b

-

Carpets

Bags & Accessories

-

Ceramics

Wooden Products

-

Bags & Accessories

Jewelry

-

Wooden Product

-

Jewelry

Women

-

Men

Turkish

Turkish

The information below is required for social login

Sign In

Create New Account